(Compliments of Craig Smith, Mortgage Master, Inc.)

While last week was packed with central bank meetings and major economic data, there was very little significant economic news this week. The small amount of data that was released this week reinforced the view that the labor market is improving. This is great for the economy, but bad for mortgage rates, and rates ended the week higher.

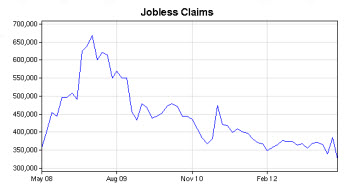

This week’s reading for Weekly Jobless Claims showed a decline to 323K, the lowest level since January 2008. This marked the third straight week that Jobless Claims were below the 350K level. Weekly Jobless Claims measure the number of new claims for unemployment benefits. There will always be some number of job changes each week, so there will always be new claims. In the years prior to 2008, Jobless Claims mostly held steady between 300K and 350K. The financial crisis then caused Jobless Claims to spike to levels above 600K during the first half of 2009. The labor market has been slowly improving since then, and it appears that Jobless Claims have finally returned to the levels seen before the financial crisis.

Jobless Claims are only one half of the employment story. The other big factor in the strength of the labor market is the number of people being hired. During a recession, companies often reduce the size of their workforce. As the economy recovers, companies first slow the pace of layoffs and then begin to retain their existing employees as business picks up. Eventually, companies reach the point where they need to add employees to meet growing demand. The stronger than expected Employment report last week and the recent Jobless Claims data provide positive indications that the economy may be at this point. Increased job gains will be great news for the economy and for the housing market.

| Average 30 yr fixed rate: | ||

| Last week: | +0.08% | |

| This week: | +0.10% | |

| Stocks (weekly): | ||

| Dow: | 15,050 | +50 |

| NASDAQ: | 3,415 | +25 |

Week Ahead

The most significant economic data next week will be the monthly inflation reports. The Producer Price Index (PPI) focuses on the increase in prices of “intermediate” goods used by companies to produce finished products and will come out on Wednesday. The Consumer Price Index (CPI), the most closely watched monthly inflation report, will come out on Thursday. CPI looks at the price change for those finished goods which are sold to consumers. In addition, Retail Sales will be released on Monday. Retail Sales account for about 70% of economic activity. Industrial Production will come out on Wednesday. Housing Starts will be released on Thursday. Empire State, Philly Fed, Consumer Sentiment, Leading Indicators and Import Prices will round out the schedule.