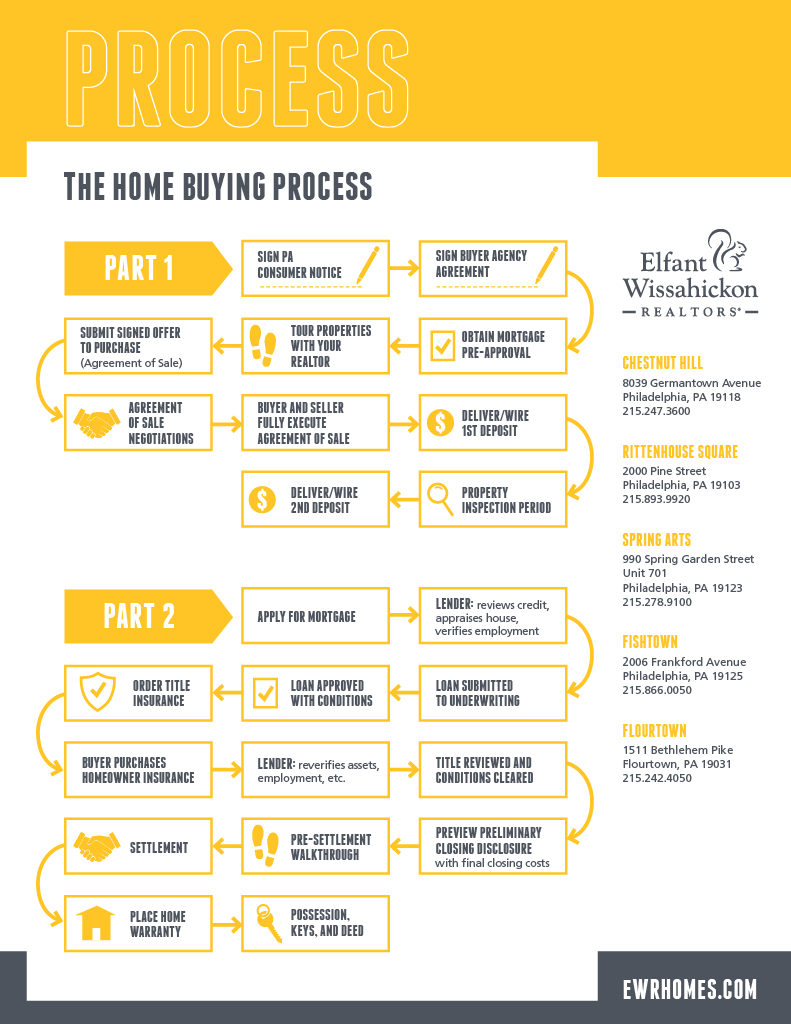

Our REALTORS are trained to guide you through the necessary steps in the Home Buying Process. Call us today to get more information and to get started!

Step 1: THE CONSUMER NOTICE

Informs you of your rights as a consumer and the business relationships permitted by law in Pennsylvania.

Step 2: BUYER BROKER CONTRACT

In order for us to represent you in the purchase of a home we must enter into a written Business Relationship.

The Commonwealth of Pennsylvania requires that enforceable business relationships between consumers and their agents be in writing. The Buyer-Broker Contract defines the responsibilities of your Broker and Agent to you as well as your responsibilities to the Broker and Agent. All the terms of the contract will be reviewed with you. These terms include which business relationship will best suit your needs, the length of the contract, and Broker’s fee information.

Step 3: PRE-PURCHASE COUNSELING

Your Elfant Wissahickon REALTOR will meet with you to discuss your criteria for a home, the locations in which you wish to search, your financing options and the offer process.

It’s advantageous to meet with your Buyer-Broker before you begin your home search. Pre-Purchase Counseling is an invaluable opportunity for you and your REALTOR to get to know each other. You’ll discuss your needs, motivation, and expectations of the Home Buying Process. Your agent will review with you the entire purchase process from identifying properties to see, obtaining financing, constructing an offer to purchase, meeting the Agreement of Sale’s contingencies, to preparing for settlement. Any questions you have will be answered by your REALTOR. It is best to be educated about the process before you begin, and you’ll be ready to make an offer as soon as you find the right home. It also helps you stay focused what is important through the course of negotiations.

Step 4: PRE-APPROVAL

Before you can begin your home search, you need to have a preapproval from a reputable mortgage company.

Elfant Wissahickon REALTORS maintains exclusive marketing agreements with Princeton Mortgage, Loan Depot, and Guaranteed Rate. These lenders have a strong history of providing high-level professional service to our clients. There may be other lenders with similar rates and services, you are free to shop around to determine that you are receiving the best overall deal based on rates and services.

Step 5: HOME SEARCH

Your Elfant Wissahickon agent has all the tools to help you find a home. Our auto-search capabilities through Bright MLS (Bright Multiple Listing Service) and RealScout allow us to email new properties to you as soon as they are listed. Our information is the most current available.

All of the homes for sale in the areas in which you are looking to live will be reviewed with you. A preview or showing of the properties you wish to see will be scheduled at your convenience. Most properties require 24 hour notice. Let your agent know in advance what your schedule needs are.

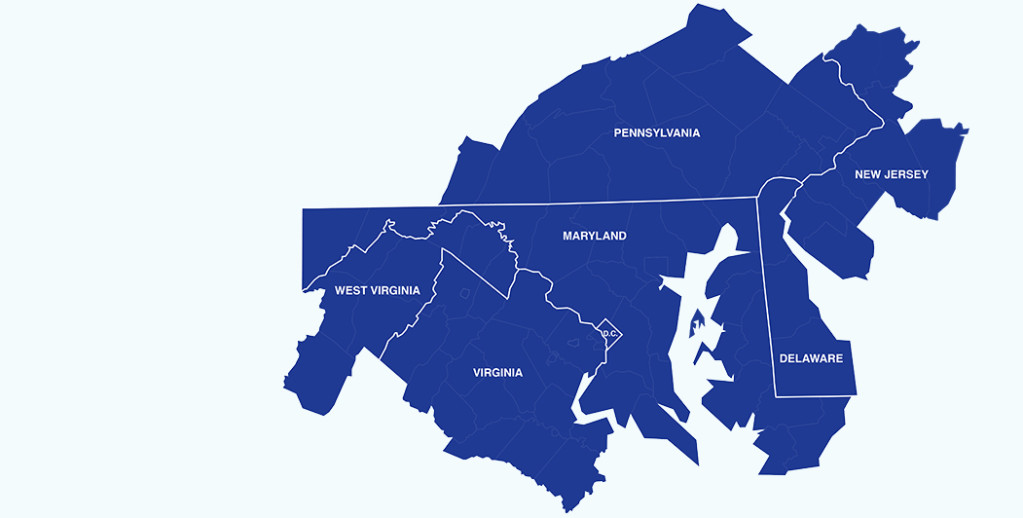

Bright MLS’ coverage area:

Step 6: MAKING AN OFFER TO PURCHASE

Your Elfant Wissahickon REALTOR will discuss the terms and contingencies of your offer, prepare the Agreement of Sale, and negotiate the offer.

When you’ve found the right house, the next phase of the purchase process begins and your goals and actions shift.

Your agent will request a copy of the Seller’s Property Disclosure for you to review and sign, perform a Competitive Market Analysis of the property to help you decide on the offer price, and complete a sample Closing Cost estimate based on that offer price.

Your offer must be presented in the form of an Agreement of Sale. The main components of the Agreement of Sale include: offering price, good faith deposits, settlement date, financing and inspection contingencies. Your agent will guide you through these main components and help you make decisions based on the current market conditions and your financial goals.

The expertise of Elfant Wissahickon REALTORS will help you understand the various terms, contingencies and responsibilities outlined in the Agreement of Sale.

Step 7: HOME INSPECTIONS

Once your offer has been accepted, you may wish to have a home inspection and environmental inspections.

The time period(s) and negotiation options offered under the Inspection Contingency will be reviewed by your Elfant Wissahickon REALTOR. Your agent will provide you with notices regarding the Home Inspection Law. A building inspection generally includes non-invasive, visual inspections of electrical, plumbing, heating, and cooling systems and built-in appliances. The full scope of your building inspection will be determined by you and your inspector. You will receive a written report, describing any material defects noted during the inspection, along with any recommendation that certain experts be retained to determine the extent of the defects and any corrective action that should be taken.

Elfant Wissahickon REALTORS does not choose a home inspection company on behalf of the Buyer. If you desire, we can provide you with a list containing the names of at least 3 home inspection service companies. You will need to receive the “Pennsylvania Home Inspector Compliance Statement,” indicating that the home inspector you hire is in compliance with PA Act 114. Unless the home inspector you hire is in compliance, the results of the inspection may not be used to further negotiate the Agreement of Sale.

Step 8: APPLYING FOR A LOAN

The PAR Agreement of Sale allows you to make an offer to purchase contingent on borrowing money to pay for the house. There are many financing (borrowing) options available.

This can be the trickiest part of the process. It is essential that you choose a reputable, licensed, experience lender who understands the local market and your borrowing capabilities. (See Step 4: Pre-Approval)

Based on when settlement of the property is to occur, you may need to apply for your loan immediately after your offer is accepted. Your mortgage officer will require documentation of your credit score, income and employment, assets and liabilities.

Step 9: TITLE INSURANCE

Our affiliated companies, Northwest Abstract and Class Abstract, can help you with the required title insurance for your home.

The Pennsylvania Association of REALTORS explains Title in this way:

The seller will transfer ownership of the property to the buyer at settlement in the form of a deed. This is known as ‘taking title to the property.’ It is always a good idea for the buyer to have a title search and to obtain title insurance – both are generally required by mortgage lenders.

The purpose of a title search is to research the history of the property to determine if there are any financial liens or claims of ownership to the property beyond the seller’s ownership. If the title search reveals that the seller can’t give ‘good and marketable title’ free of other liens or claims, the buyer may terminate the sale and have all deposit monies returned.

Title insurance is meant to protect buyers from claims or liens that may be discovered after the purchase is complete. For example, if a lien wasn’t properly filed against the property and is only discovered several years after purchasing the property, a title insurance policy should pay some or all of the costs of addressing that problem. There are a number of variations on title insurance, including some policies that cover certain property defects or the failure of prior owners to obtain proper permits for work done to the property. Buyers should talk to their title insurer about the extent of protection offered by the title insurance policy.’

Our title insurance companies, Northwest Abstract and Class Abstract, can help you with any of your title needs.

Northwest Abstract (215) 233-0888

Class Abstract (215) 487-1977

Step 10: SETTLEMENT

You have purchased a home! We will help you prepare for a successful settlement.

Settlement (or Closing) is the final step in executing your real estate transaction.

Up to 24 hours before the settlement, your agent will take you on a ‘walk-through’ of the building, so that you can ensure it is empty, broom clean, and in the same condition in which you purchased the property. You will inspect any repairs done to the house as a result of the building inspection.

The closing is usually held at the office of the buyer’s title company, real estate company, lending institution or attorney’s office. The title officer usually conducts the closing meeting. Your Elfant Wissahickon REALTOR will be with you at settlement.

The closer will prepare the closing statement (Alta, American Land Title Association form) with the buyer and seller to itemize all receipts and expenditures including prorated adjustments. Your REALTOR will review this with you prior to closing.

The closing agent will obtain necessary signatures on all documents, including the deed. The buyer pays the balance due on the purchase price and closing expenses with either a cashier’s or certified check.

The Seller receives the proceeds from the sale of the property and conveys title by Special Warranty Deed to the Buyer.

The closing officer records pertinent documents in the public records.

Congratulations! You now own the property! You take possession of the property by accepting the signed deed, the keys and taking physical possession.